U.S. stock futures fell on Tuesday after Monday’s lower close. Futures of major benchmark indices declined.

On Monday, the Nasdaq Composite dropped more than 100 points, following a week in which the S&P 500 lost 0.6% while the Dow rose 1.1%.

Traders have now turned their attention to Tuesday’s economic calendar, which features the release of official payroll data for October and November alongside October retail sales.

Meanwhile, the 10-year Treasury bond yielded 4.16% and the two-year bond was at 3.49%. The CME Group’s FedWatch tool‘s projections show markets pricing a 73.4% likelihood of the Federal Reserve leaving the current interest rates unchanged.

| Futures | Change (+/-) |

| Dow Jones | -0.25% |

| S&P 500 | -0.36% |

| Nasdaq 100 | -0.51% |

| Russell 2000 | -0.40% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Tuesday. The SPY was down 0.42% at $677.87, while the QQQ declined 0.59% to $606.95, according to Benzinga Pro data.

Stocks In Focus

Roku

- Roku Inc. (NASDAQ:ROKU) shares jumped 4.10% in premarket on Tuesday after its CFO and COO, Jedda Dan, sold 3,000 shares of Class A Common Stock on Dec. 15, for $107.44 per share, totaling $322,320. Also, as per an investing.com report, Morgan Stanley upgraded the stock from Equalweight to Overweight on Tuesday, raising its price target to $135.00 from $85.00.

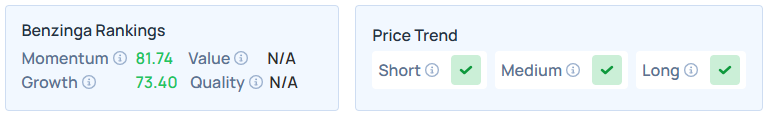

- It maintains a stronger price trend over the short, medium, and long terms, with a solid growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Blue Owl Capital

- Blue Owl Capital Inc. (NYSE:OWL) rose 1.22% after announcing an enhanced strategic partnership with Finance of America Companies that includes a $2.5 billion commitment and a $50 million equity injection to support the lender’s expansion into new home equity-based financial products for retirees.

- Benzinga’s Edge Stock Rankings indicate that OWL maintains a stronger price trend over the short term but a weak trend in the medium and long terms, with a poor value ranking. Additional performance details are available here.

B Riley Financial

- B Riley Financial Inc. (NASDAQ:RILY) surged 25.54% after reporting earnings of $4.50 per share for the second quarter, versus a year-ago loss of $14.35 per share. The company’s sales surged to $225.302 million from $94.885 million.

- RILY maintains a weaker price trend over the medium term but a strong trend in the short and long terms, with a poor growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Navan

- Navan Inc. (NASDAQ:NAVN) tumbled 11.17% after posting upbeat results for the third quarter, but issuing weaker-than-expected FY2026 guidance. The company stated that it anticipates FY2026 sales of $685.00 million to $687.00 million, compared to market estimates of $830.87 million.

- Benzinga’s Edge Stock Rankings shows that NAVN maintains a weaker price trend over the short, long, and medium terms. Additional information is available here.

Lennar

- Lennar Corp. (NYSE:LEN) was 0.025% lower as analysts expected it to report earnings of $2.21 per share on revenue of $9.02 billion after the closing bell.

- LEN maintained a weaker price trend over the short, medium, and long terms, with a poor quality ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

While energy, health care, utilities, and consumer discretionary stocks recorded the day’s biggest gains, the information technology sector bucked the positive trend to close lower, leaving U.S. stocks in the red on Monday.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -0.59% | 23,057.41 |

| S&P 500 | -0.16% | 6,816.51 |

| Dow Jones | -0.086% | 48,416.56 |

| Russell 2000 | -0.81% | 2,530.67 |

Insights From Analysts

Based on the LPL Research commentary, Chief Equity Strategist Jeffrey Buchbinder forecasts that the current bull market is “poised to extend its run in 2026.”

He identifies two primary drivers for this continued optimism: “ongoing enthusiasm around AI” and the “further easing of monetary policy” from the Federal Reserve.

However, Buchbinder warns that potential gains “may be more tempered” compared to previous years due to high valuations and the historical volatility associated with midterm election years.

Economically, LPL Research anticipates a scenario where the economy “slows gradually… enabling additional Fed rate cuts without triggering a recession.”

This backdrop supports their year-end 2026 S&P 500 fair value target range of 7,300 to 7,400. Buchbinder notes that massive capital expenditures in artificial intelligence (AI) are projected to reach approximately $520 billion in 2026 and will be crucial for powering earnings growth.

Despite risks such as “potential AI disappointments” or rising interest rates, his advice to investors is to “maintain current allocations near long-term targets” and use market pullbacks as opportunities to selectively increase exposure.

See Also: How to Trade Futures

Upcoming Economic Data

Here’s what investors will be keeping an eye on Tuesday;

- November’s delayed U.S. employment report, unemployment rate, and hourly wages, along with October’s delayed U.S. retail sales, will be released at 8:30 a.m. ET.

- December’s S&P flash U.S. services PMI and manufacturing PMI will be out by 9:45 a.m., whereas September’s business inventories data will be released by 10:00 a.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 1.66% to hover around $55.73 per barrel.

Gold Spot US Dollar rose 0.58% to hover around $4,280.22 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.09% lower at the 98.2190 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 3.94% lower at $86,329.61 per coin.

Asian markets closed lower on Tuesday, as India’s NIFTY 50, Australia’s ASX 200, Hong Kong’s Hang Seng, China’s CSI 300, South Korea’s Kospi, and Japan’s Nikkei 225 indices fell. European markets were mixed in early trade.

Read Next:

Photo courtesy: Shutterstock

Recent Comments