Legendary investor Michael Burry, best known for predicting the 2008 financial crisis, admitted in a candid Substack post on Tuesday that he sold his massive GameStop Corp. (NYSE:GME) position just weeks before the historic January 2021 rally.

Despite initiating the trade in 2019 and pushing the board toward the aggressive share buybacks that reduced the float, Burry’s Scion Asset Management, which is now de-registered, exited in the fourth quarter of 2020, missing a potential $1 billion windfall.

Check out GME’s stock price here.

Selling Before The Explosion

Burry revealed that Scion held approximately 3 million shares with an average cost basis of roughly $3.32 (pre-split). However, he sold the entire position as the stock reached the mid-teens in late 2020.

Burry attributed the early exit to skepticism regarding activist investor Ryan Cohen. While he recognized Cohen as a “deep value investor” during a private 2019 meeting, Burry viewed Cohen’s November 2020 “tech-forward” manifesto as fraught with “execution risk.”

Preferring the concrete returns of buybacks over vague digital transformation plans, and facing client withdrawals at Scion, Burry cashed out.

See Also: GameStop Shares Slide As Revenue Miss Overshadows Earnings Beat

Anatomy Of A ‘Legal Corner’

Burry offered a technical post-mortem of the event, describing it as the only “legal market corner” he has ever witnessed.

He detailed how retail traders utilized a “gamma squeeze”—buying massive volumes of call options—to force market makers like Citadel and Virtu to buy the underlying stock to maintain delta neutrality.

Burry dismissed the popular theory that “naked short selling” was the primary driver, arguing instead that the volatility broke the standard “layering” of synthetic positions, forcing a panic unwind by legal short sellers.

The ‘Village S**t’ Strategy

The post, titled “GameStop, The Prequel,” links the trade to Burry’s 2001 investment in Avanti, a scandal-ridden software company he bought for pennies on the dollar.

He applied this same “Village S**t” strategy—buying unloved companies with deep value—to GameStop in 2019.

While his fundamental thesis was correct, he admitted to being “blinded” by traditional valuation metrics, failing to foresee the retail mania that would turn the “melting ice cube” into a global phenomenon.

GME Underperforms In 2025

GME shares have declined 27.95% year-to-date and 24.97% over the year. Meanwhile, it was down 5.27% over the last six months and advanced 7.76% in the last month.

The stock closed 4.05% higher at $22.09 apiece on Monday. It was down 0.32% in premarket on Tuesday.

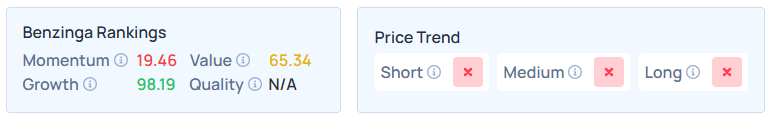

Benzinga’s Edge Stock Rankings indicate that GME maintains a weaker price trend over the short, medium, and long terms, with a solid growth ranking. Additional performance details are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments