Retail investors talked up five hot stocks this week (Dec. 8 to Dec. 12) on X and Reddit’s r/WallStreetBets, driven by earnings, retail hype, AI buzz, and corporate news flow.

The stocks, Broadcom Inc. (NASDAQ:AVGO), Oracle Corp. (NYSE:ORCL), Netflix Inc. (NASDAQ:NFLX), Carvana Co. (NYSE:CVNA), and Microsoft Corp. (NASDAQ:TSLA), spanning semiconductors, AI, software, streaming, and automotive, reflected diverse retail interests.

Broadcom

- AVGO dominated headlines with its fiscal fourth quarter earnings release on Dec. 11, reporting record revenue of $18 billion and non-GAAP EPS of $1.95, beating estimates amid surging AI demand—AI revenue grew 74% YoY to $6.5 billion, with custom chips and networking backlog hitting $73 billion for the next 18 months. However, the stock fell as investors focused heavily on disappointing guidance regarding shrinking gross margins and a sharply higher tax rate for fiscal 2026.

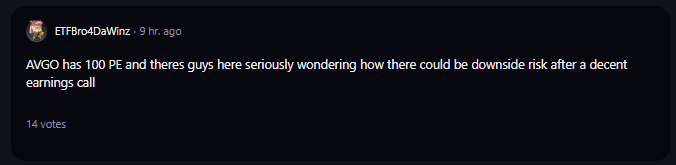

- Some retail investors also flagged AVGO’s valuation, apart from its profitability hurdles, as a reason for the sell-off.

- The stock had a 52-week range of $138.10 to $414.61, trading around $388 to $407 per share, as of the publication of this article. It was up 75.17% year-to-date and 124.94% over the year.

- The stock had a stronger price trend in the short, medium, and long terms, with a poor value ranking, as per Benzinga’s Edge Stock Rankings. Other performance details are available here.

Oracle

- ORCL reported fiscal second quarter 2026 earnings on Dec. 10, posting total revenue of $16.1 billion and cloud revenues of $8.0 billion, alongside a massive 438% surge in remaining performance obligations to $523 billion on AI demand from clients like OpenAI and Meta Platforms Inc. (NASDAQ:META). Chairman and CTO Larry Ellison said his company will purchase chips from any producer, dubbing the policy “chip neutrality.” Meanwhile, the firm forecasted a $15 billion increase in capital expenditures for fiscal 2026 to fulfill the backlog, along with an additional $4 billion in sales by fiscal 2027 amid faster backlog conversion.

- Some retail investors were still bullish on ORCL after its earnings.

- The stock had a 52-week range of $118.86 to $345.72, trading around $197 to $200 per share, as of the publication of this article. It was up 19.77% year-to-date and 13.42% over the year.

- Benzinga’s Edge Stock Rankings showed that the stock had a stronger price trend in the short, medium, and long terms, with a solid quality ranking. Additional performance details are available here.

See Also: META, NFLX, CRM, And More: 5 Stocks That Dominated Investor Buzz This Week

Netflix

- NFLX shook up Hollywood by announcing on Dec. 5 its $82.7 billion acquisition of Warner Bros Discovery Inc.‘s (NASDAQ:WBD) studios and streaming assets, aiming to bolster content firepower amid streaming wars, with projected $2-3 billion in initial synergies but sparking immediate backlash over regulatory hurdles, debt load, and integration risks. The deal faced a hostile $108 billion counterbid from Paramount Skydance Corp. (NASDAQ:PSKY) by Dec. 8, escalating to a shareholder lawsuit against Netflix on Dec. 9.

- Retail investors were bullish on NFLX regardless of the bidding war.

- The stock had a 52-week range of $82.11 to $134.12, trading around $94 to $97 per share, as of the publication of this article. It was up 6.11% year-to-date and 1.65% over the year.

- The stock had a weaker price trend in the short, medium, and long terms, with a solid quality ranking, as per Benzinga’s Edge Stock Rankings. Other performance details are available here.

Carvana

- CVNA dominated headlines with its S&P 500 inclusion announced on Dec. 5—effective Dec. 22—sparking an explosive rally. Meanwhile, the Federal Reserve cut the rates by 25 basis points on Wednesday, further boosting the stock.

- Some investors raised doubts about the S&P 500’s inclusion of CVNA.

- The stock had a 52-week range of $148.25 to $475.00, trading around $472 to $474 per share, as of the publication of this article. It was up 136.89% YTD and 90.79% over the year.

- According to Benzinga’s Edge Stock Rankings, it was maintaining a stronger price trend over short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

Microsoft

- MSFT kicked off with its annual shareholders meeting on Dec. 5, approving the 2026 Stock Plan, re-electing 12 directors, ratifying Deloitte as auditor, and greenlighting executive compensation amid ESG scrutiny. CEO Satya Nadella announced a landmark $23 billion AI investment push, including $17.5 billion in India—its largest Asia commitment—for cloud infrastructure and skilling 20 million by 2030, plus $5.4 billion in Canada for Azure capacity online by late 2026, alongside a $0.91/share dividend payout on Dec. 11.

- A few retail investors were excited about the dividends they received.

- The stock had a 52-week range of $344.79 to $555.45, trading around $483 to $485 per share, as of the publication of this article. It was up 15.50% year-to-date but 7.54% higher over the year.

- It maintains a stronger price trend over the long term and a weak trend in the short and medium terms, with a strong growth score, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Retail focus blended meme-driven narrative with earnings outlook and corporate news flow, as the S&P 500, Dow Jones, and Nasdaq largely witnessed positive market action during the week.

Read Next:

Image via Shutterstock

Recent Comments