The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Perfect Corp (NYSE:PERF)

- On July 29, Perfect reported a second-quarter adjusted EPS miss. Ms. Alice H. Chang, the Founder, Chairwoman, and Chief Executive Officer of Perfect commented, “Our mobile app and web subscription business continues to demonstrate strong momentum, now growing significantly faster than our enterprise segment. B2C subscriptions have become the primary driver of our overall revenue growth, fueled by sustained demand for our photo- and video-based generative AI features.” The company’s stock fell around 22% over the past five days and has a 52-week low of $1.51.

- RSI Value: 29.8

- PERF Price Action: Shares of Perfect fell 16.3% to close at $2.05 on Tuesday.

- Edge Stock Ratings: 30.66 Momentum score with Value at 70.05.

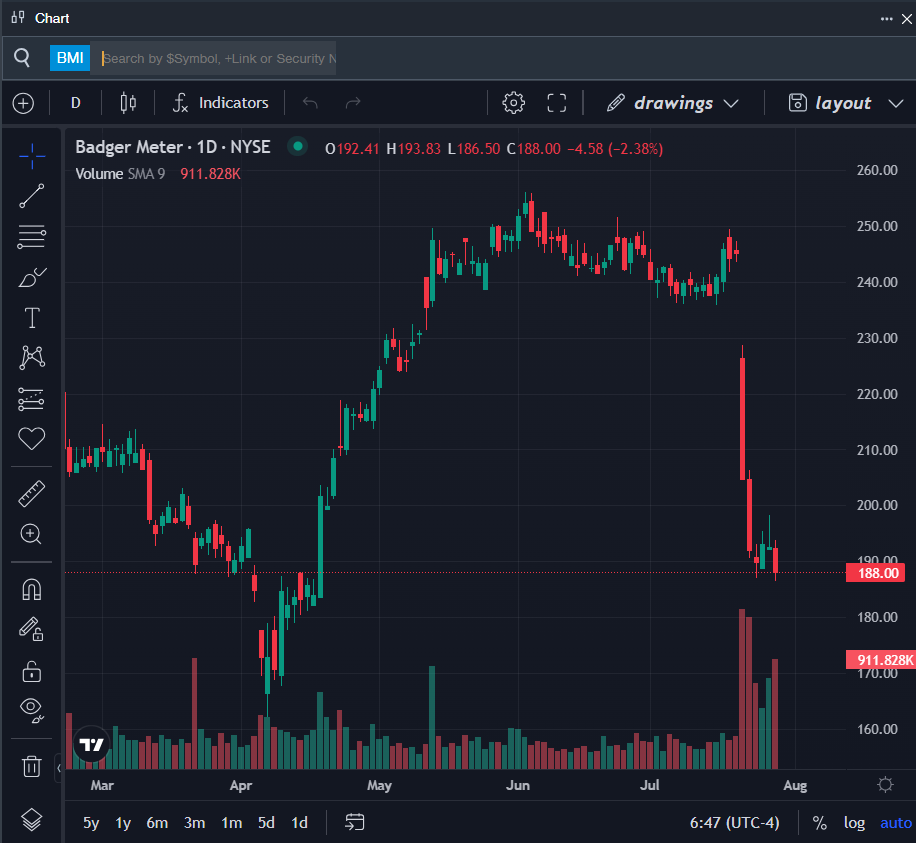

Badger Meter Inc (NYSE:BMI)

- On July 22, Badget Meter announced a second-quarter EPS miss. “We delivered strong sales growth, solid profitability and robust cash flow against last year’s quarterly sales high-water mark,” said Kenneth C. Bockhorst, Chairman, President and Chief Executive Officer. The company’s stock fell around 23% over the past month and has a 52-week low of $162.17.

- RSI Value: 18.6

- BMI Price Action: Shares of Badger Meter fell 2.4% to close at $188.00 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in BMI stock.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Photo via Shutterstock

Recent Comments