The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Amber International Holding Ltd (NASDAQ:AMBR)

- On July 7, Amber International announced it filed for a $500 mixed shelf offering. The company’s stock fell around 38% over the past month and has a 52-week low of $1.55.

- RSI Value: 27.6

- AMBR Price Action: Shares of Amber International fell 14.3% to close at $7.28 on Friday.

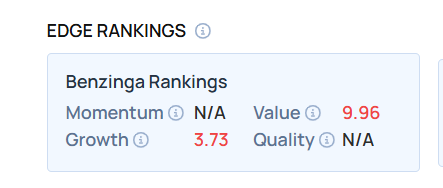

- Edge Stock Ratings: Value at 9.96.

FingerMotion Inc (NASDAQ:FNGR)

- On July 15, FingerMotion posted a first-quarter loss of 4 cents per share, versus a year-ago loss of 3 cents per share. “While topline revenue showed modest movement, with margin pressure driven by evolving business dynamics, we are encouraged by the initial revenue contribution from our Command and Communication platform, as well as the steady buildout of the DaGe and Big Data businesses,” said Martin Shen, CEO of FingerMotion. The company’s stock fell around 21% over the past month and has a 52-week low of $1.03.

- RSI Value: 27

- FNGR Price Action: Shares of FingerMotion fell 1.2% to close at $1.63 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in FNGR stock.

Anterix Inc (NASDAQ:ATEX)

- On June 24, Anterix posted downbeat quarterly sales. The company’s stock fell around 19% over the past month and has a 52-week low of $22.50.

- RSI Value: 27.51

- ATEX Ltd Price Action: Shares of Anterix gained 0.3% to close at $22.84 on Friday.

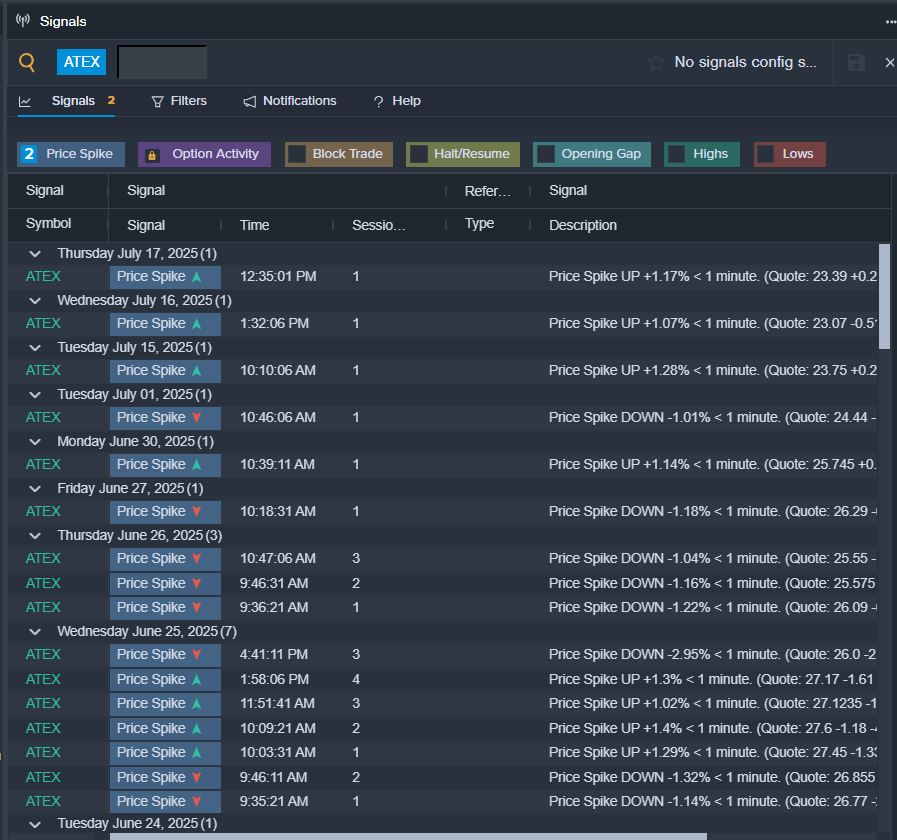

- Benzinga Pro’s signals feature notified of a potential breakout in ATEX shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Recent Comments