During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

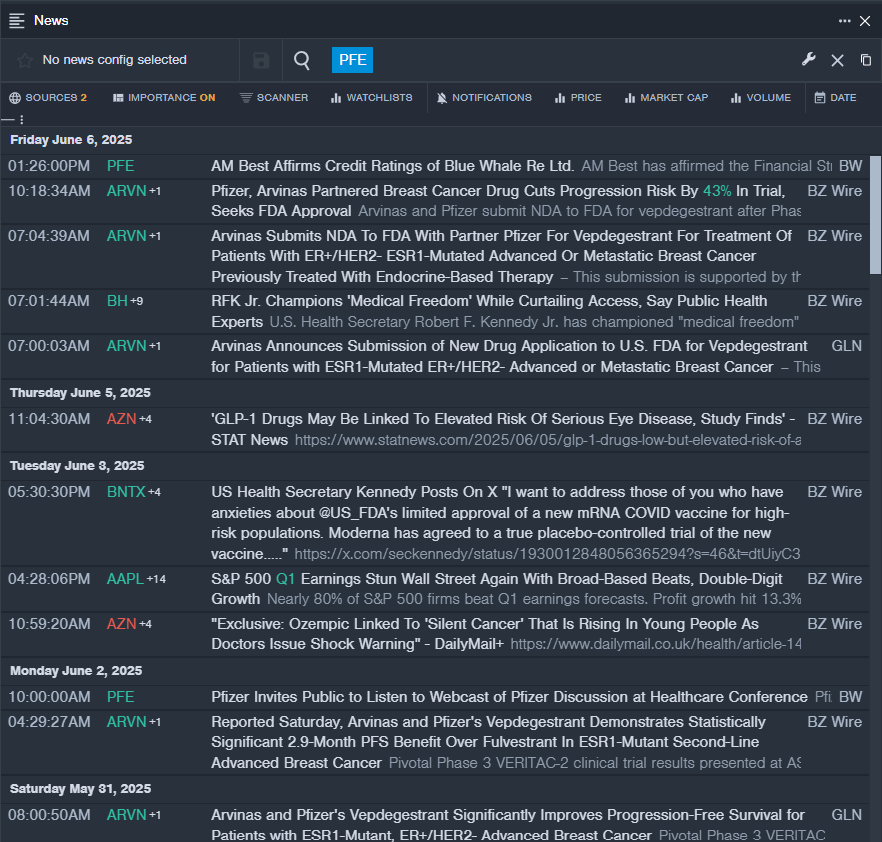

Pfizer Inc. (NYSE:PFE)

- Dividend Yield: 7.37%

- UBS analyst Trung Huynh maintained a Neutral rating and raised the price target from $24 to $25 on April 30, 2025. This analyst has an accuracy rate of 70%.

- Guggenheim analyst Vamil Divan reiterated a Buy rating on March 18, 2025. This analyst has an accuracy rate of 74%.

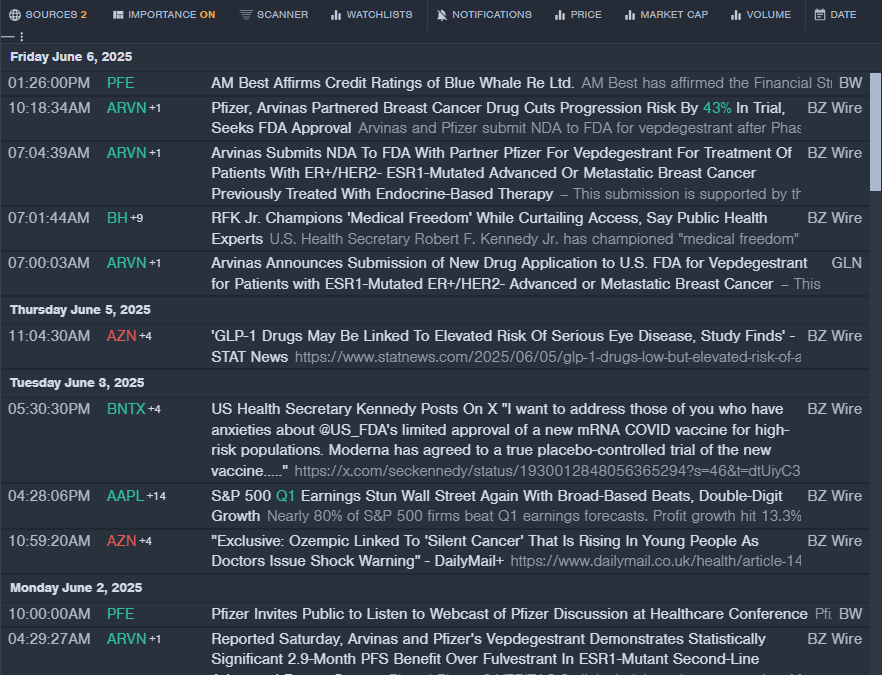

- Recent News: Arvinas, Inc. (NASDAQ:ARVN) on Friday announced in a press release the submission of a New Drug Application to the U.S. Food and Drug Administration (FDA) with its partner Pfizer.

- Benzinga Pro’s real-time newsfeed alerted to latest PFE news.

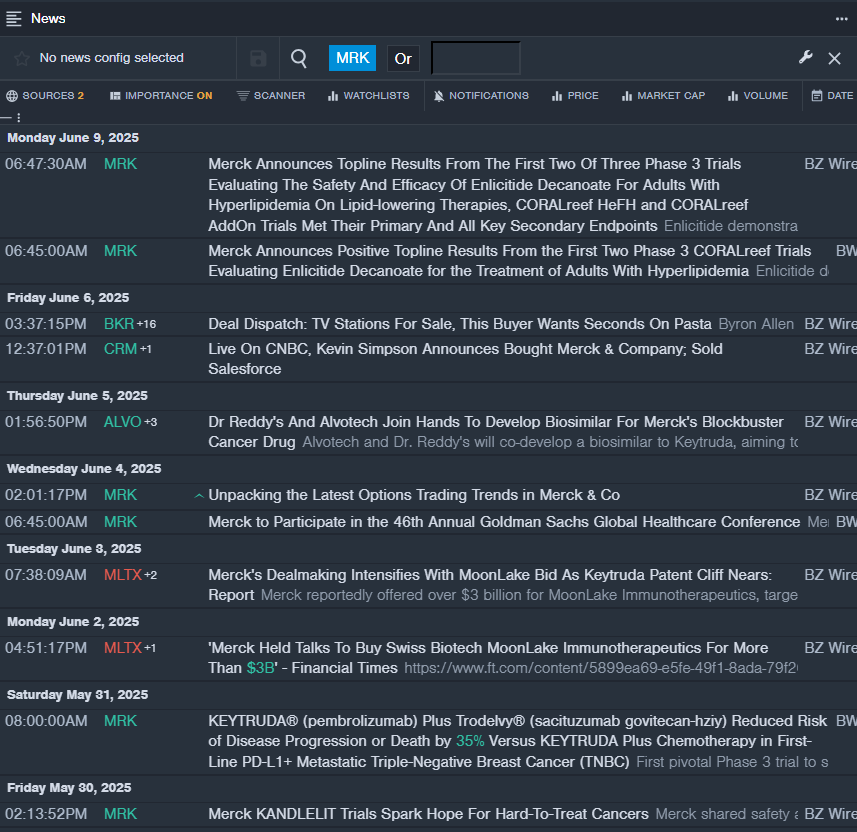

Merck & Co., Inc. (NYSE:MRK)

- Dividend Yield: 4.10%

- Citigroup analyst Andrew Baum downgraded the stock from Buy to Neutral and cut the price target from $115 to $84 on May 14, 2025. This analyst has an accuracy rate of 69%.

- Guggenheim analyst Vamil Divan reiterated a Buy rating with a price target of $115 on April 17, 2025. This analyst has an accuracy rate of 74%.

- Recent News: On Monday, Merck reported positive topline results from the first two Phase 3 CORALreef trials evaluating enlicitide decanoate for the treatment of adults with hyperlipidemia.

- Benzinga Pro’s real-time newsfeed alerted to latest MRK news

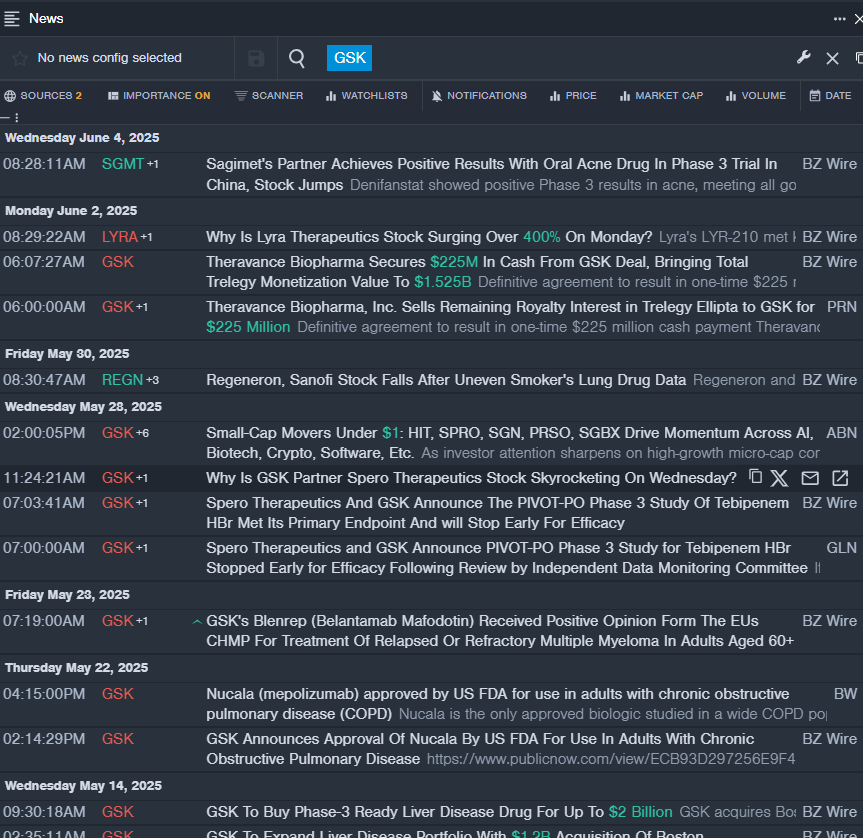

GSK plc (NYSE:GSK)

- Dividend Yield: 3.88%

- Oppenheimer analyst Rupesh Parikh maintained an Outperform rating and raised the price target from $87 to $93 on Feb. 13, 2025. This analyst has an accuracy rate of 72%.

- Canaccord Genuity analyst Susan Anderson maintained a Buy rating and increased the price target from $93 to $100 on Feb. 7, 2025. This analyst has an accuracy rate of 67%.

- Recent News: GSK and Spero Therapeutics Inc (NASDAQ:SPRO), on May 28, announced that the pivotal phase 3 PIVOT-PO trial evaluating tebipenem HBr for complicated urinary tract infections (cUTIs) will stop early for efficacy.

- Benzinga Pro’s real-time newsfeed alerted to latest GSK news

Read More:

Photo via Shutterstock

Recent Comments